How to Organize Your Financial Documents for Tax Season

- Gloria

- Dec 9, 2025

- 2 min read

Year-End Tax Moves for Individuals and Small Business Owners

For many individuals and small business owners, tax season feels overwhelming long before the first form arrives. A simple, consistent system for organizing your financial documents reduces stress and helps you take full advantage of the 2025 updates introduced in the One Big Beautiful Bill (OBBB).

Why Document Organization Matters More in 2025

OBBB introduced new reporting thresholds and expanded credits, which means the IRS now expects more complete documentation. Key changes include:

More taxpayers receiving Form 1099-K due to updated third-party payment reporting rules.

Expanded energy-efficiency credits requiring detailed proof of purchase and installation.

Increased substantiation requirements for business expenses, including mileage and home-office costs.

With these updates, accurate and accessible records are essential—not optional.

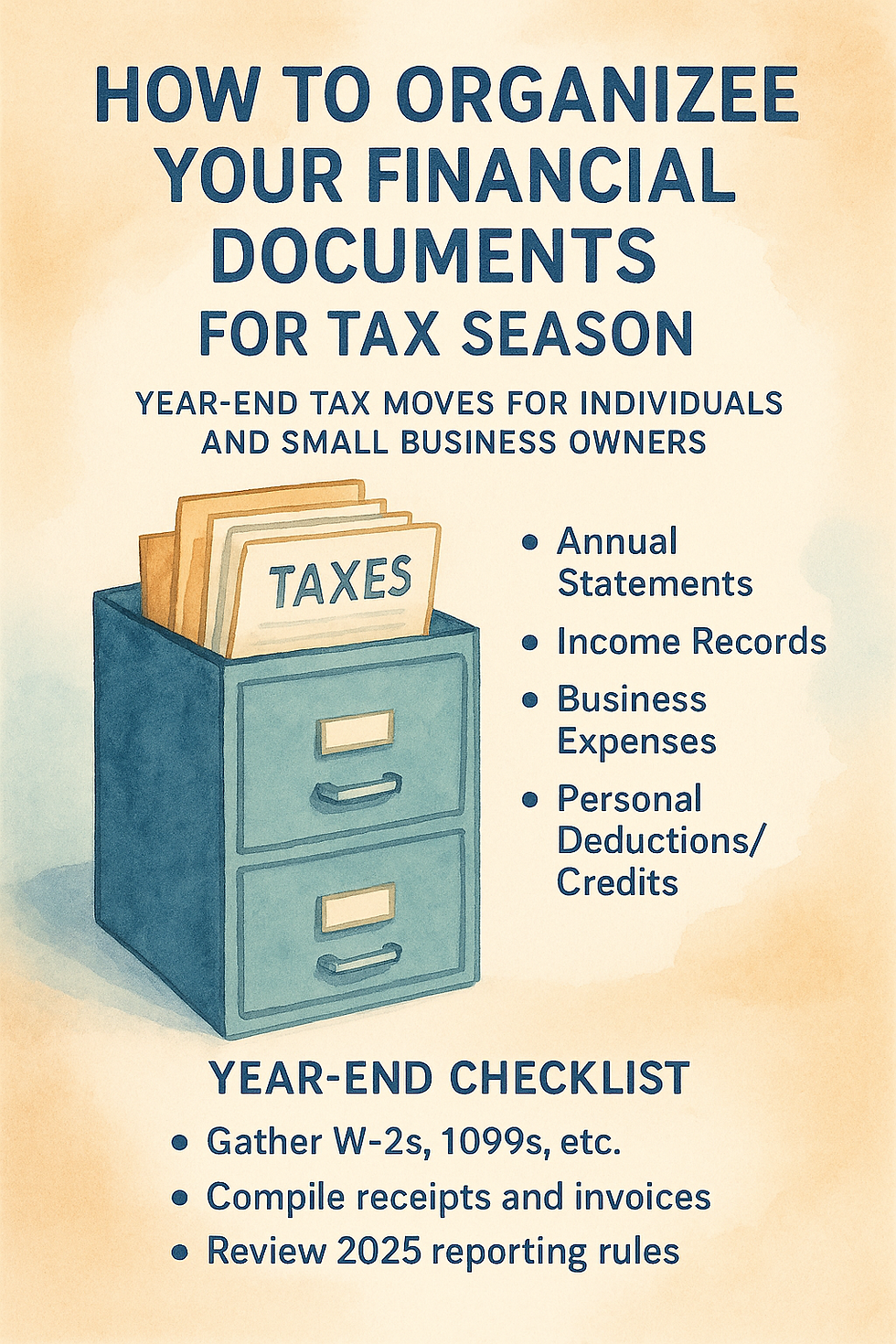

Set Up a System to Organize Tax Documents

Choose a system you’ll actually maintain. At minimum, create folders—digital or paper—for:

Annual Statements: W-2s, 1099s, 1098s, brokerage summaries, Social Security forms.

Income Records: Invoices, payment confirmations, processor reports, and notes on non-revenue deposits.

Business Expenses: Receipts, invoices, mileage logs, software subscriptions, and utility records for home-office claims.

Personal Deductions/Credits: Charitable donations, childcare and education expenses, medical bills, and energy-efficient home improvements.

Health Insurance: Form 1095s and HSA contribution and expense records.

Consistency matters more than complexity.

Digital or Paper? Choose Your Best Fit

Both work—what matters is using one reliably.

Digital Systems:

Store documents in cloud folders labeled by tax year.

Use predictable file names (e.g., “2025-07-Utility-Invoice”).

Keep backups.

Paper Systems:

Use clearly labeled folders for each category.

Store everything in one location to avoid lost documents.

Track Key Items Affected by OBBB

Certain categories require especially careful documentation this year:

Energy-Efficient Home Credits: Save invoices, receipts, and manufacturer certifications.

Third-Party Payment Reporting: Expect more Form 1099-Ks; keep monthly payment processor statements.

Business Mileage & Mixed-Use Assets: Maintain contemporaneous logs and records showing business purpose.

Child- and Family-Related Credits: Keep childcare invoices and dependent-support records.

A Quick Year-End Checklist

Before filing season begins, gather:

All W-2s, 1099s, 1095s, and annual statements.

Year-end bookkeeping reports and reconciliations.

Receipts for deductible expenses and home improvements.

Proof of payments for childcare, education, and medical expenses.

Any documents tied to new 2025 credit or reporting requirements.

Conclusion: Small Systems Make Filing Smoother

A little organization now saves time and reduces stress during tax season—especially under the expanded documentation rules in the One Big Beautiful Bill. Setting up a simple, repeatable system ensures you don’t miss deductions or scramble to track down paperwork when deadlines arrive.

The information provided in this blog is for general informational purposes only and is not intended to be comprehensive or serve as professional advice. Every business and financial situation is unique. I encourage you to consult with a qualified professional to address your specific needs and circumstances.

Comments