Federal Reporting Deadlines

- Gloria

- Dec 31, 2024

- 2 min read

Updated: Jan 2, 2025

As a small business owner, keeping up with federal reporting deadlines can feel overwhelming. January is particularly busy, with several key filings due. To help you stay on top of your obligations, here’s a quick guide to the federal forms you need to file this month. By understanding these requirements, you can avoid penalties and start the year on the right foot.

Federal Reporting Deadlines in January:

What Small Business Owners Need to Know

1. Employee Wage Reporting: W-2 Forms

If you have employees, you’re required to issue Form W-2 by January 31. This form reports wages paid and taxes withheld during the previous year. You must provide copies to your employees and file them with the Social Security Administration (SSA). Don’t forget to include Form W-3, which summarizes all W-2s.

2. Independent Contractor Payments: 1099-NEC Forms

Did you pay $600 or more to any independent contractors in the past year? If so, you’ll need to issue Form 1099-NEC to those contractors and file it with the IRS by January 31. This form reports nonemployee compensation and helps contractors accurately report their income.

3. Other 1099 Forms

If you’ve made other reportable payments, such as rent or royalties, you may need to issue Form 1099-MISC. While copies to recipients are due January 31, you have until February 28 (paper filing) or March 31 (electronic filing) to submit them to the IRS.

4. Payroll Tax Filings

Employers are also responsible for payroll tax reporting:

Form 941 (Quarterly Federal Tax Return): This form covers the fourth quarter of the previous year and is due January 31.

Form 940 (Annual FUTA Tax Return): This annual filing reports federal unemployment taxes and is also due by January 31.

5. Health Coverage Reporting: 1095-B and 1095-C

If you offer health insurance to your employees, you may need to file Forms 1095-B or 1095-C. These forms provide information about the coverage offered and are due to employees by January 31. Filing with the IRS has separate deadlines: February 28 for paper filing or March 31 for electronic filing.

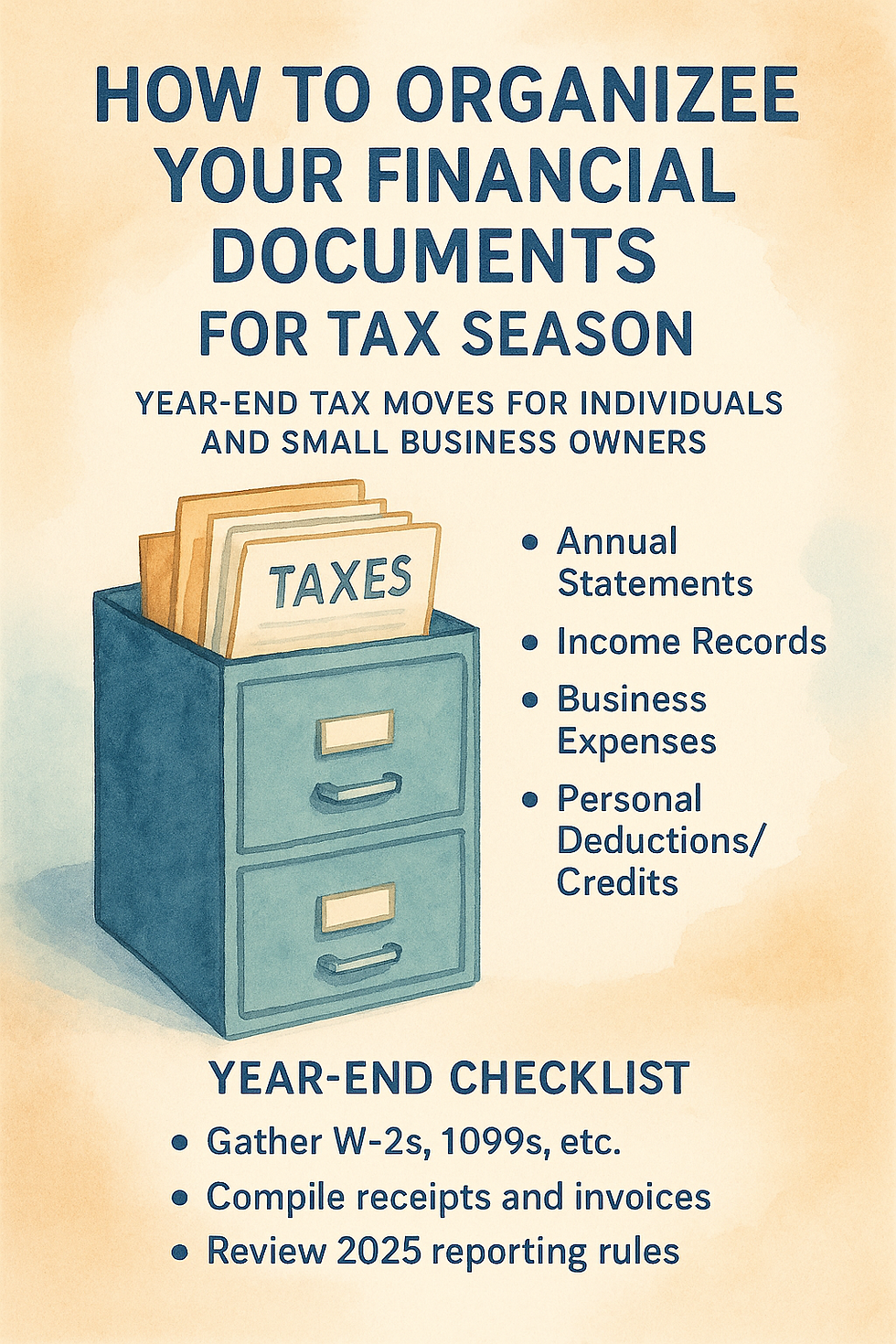

Tips for Staying Organized

Start early: Preparing these forms takes time, especially if you’re gathering information from various sources.

Use technology: Accounting software can simplify reporting and ensure accuracy.

Consult a professional: If you’re unsure about your obligations, a virtual accountant or tax advisor can provide guidance tailored to your business.

Don’t Let Deadlines Sneak Up

January’s reporting requirements may seem daunting, but staying organized can make all the difference. Many small businesses use payroll companies to handle filings like Forms 941 and 940, making it easier to focus on other responsibilities. Whether you manage reporting yourself or rely on external support, meeting these deadlines helps you avoid penalties and start the year with confidence.

If you need assistance, don’t hesitate to reach out for expert guidance. Let’s make 2025 your most organized year yet!

The information provided in this blog is for general informational purposes only and is not intended to be comprehensive or serve as professional advice. Every business and financial situation is unique. I encourage you to consult with a qualified professional to address your specific needs and circumstances.

Comments